Q & A with John Adzema, President, National Associates, Inc.

Written by: Jeff Hedrich, The Prodigal Company

Founded in 1946, National Associates, a wholly owned subsidiary of Farmers National Bank, is a Third-Party Administrator (TPA) of just under 500 hundred – and counting – company retirement plans developed in partnership with Farmers Trust Company and external investment advisors. In this interview, John Adzema discusses how National Associates helps business owners navigate the myriad of legal and operational issues regarding retirement plans – and how they can prepare for the tidal wave of rule changes coming over the next several years.

Capital Ideas

John, help us understand the crucial role of a Third-Party Administrator when working with retirement plans.

Adzema

We don’t seek out the retirement plan business directly - that’s a sales function of our Trust Company and external investment advisors. As a TPA, we are responsible for creating or updating the legal plan document and regulatory disclosures, setting up and administering the plan on a record-keeping system, and monitoring the numerous compliance rules associated with a retirement plan. We also prepare and file the plan’s Form 5500 with the IRS every year which is similar to a personal tax return. We help with employee distributions and loans. We consult on all types of compliance questions. We also provide the calculations if the company is contributing profit sharing to its employees. In reality, this is important work because the vast majority of the fines and penalties arising out of retirement plan violations come from the operational side when things aren’t done correctly. Our job is to make sure that doesn’t happen to our clients.

CI

If I’m a business owner, what would I want to know about how NAI is going to help me?

Adzema

First, you are going to be assigned a dedicated Plan Consultant and they are your main point of contact. Our Plan Consultants average 24 years of industry experience, which represents a depth of knowledge about a very complex field. We can administer everything from a one-person startup plan to a plan for several thousand employees. We work with the business owners to help them save as much money as they can for retirement, while being fair to their employees. Many owners have poured their blood, sweat and tears into their business and haven't really saved for themselves. So, we want to give them a means of putting away a meaningful retirement benefit for themselves down the road. Your plan might be to sell the business one day and that will be your retirement nest egg, but you don't know what the economy or the value of your business is going to be at that point in time. That's where we come in with a consultative approach to determine a maximum annual contribution strategy for the owner that meets all the legal requirements yet keeps the contributions to staff at an efficient level.

CI

Many entrepreneurs have a DIY attitude. What are the challenges of setting up a plan yourself?

Adzema

Whenever we take over a plan or set up a plan, we go through what's called the conversion phase. If you don't set up everything perfectly during that installation or conversion phase, you're going to have problems down the road. Maybe contributions get put into the wrong money source on the record-keeping platform or maybe the plan is set up so participants can take loans, but wasn’t set up correctly at the record-keeper. So an employee goes to take a loan from their account for the first time and the employee’s much needed loan is delayed. It's much harder to fix something after the fact because now you need to make the participants whole if you did something wrong. You have to reverse out transactions and then if the market lost money during that time, you’ve got to make it up. That’s just one example of how plans can go south if not properly set up, and let’s be honest, most entrepreneurs have better things to do with their time.

CI

Many small businesses don’t have retirement plans. Is that a mistake?

Adzema

Unfortunately, about half of all businesses with 25 or fewer employees don’t have retirement plans, despite the government creating incentives to encourage owners to offer plans. If you don’t offer a plan, you’re missing out on tax credits for your company. It’s never too late. If you start a retirement plan now, you will gain dollar for dollar credits against your corporate tax for the first three years of the plan. Basically for every employee you employ, the government will give you a $250 credit for each up to a maximum of $5,000. That’s just one reason to offer a plan, but it’s an important one.

CI

The retirement plan world is being transformed right now. What exactly is unfolding?

Adzema

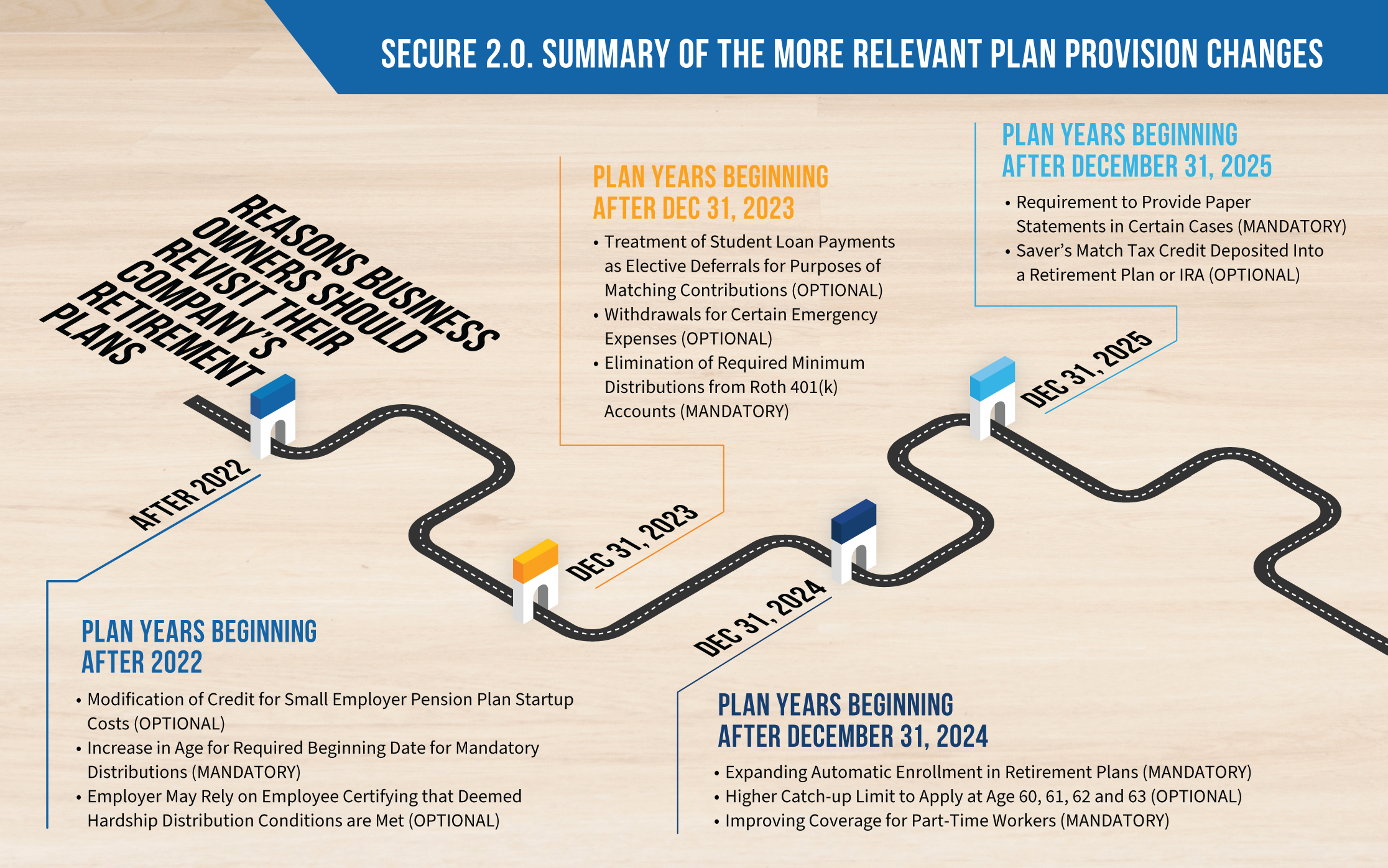

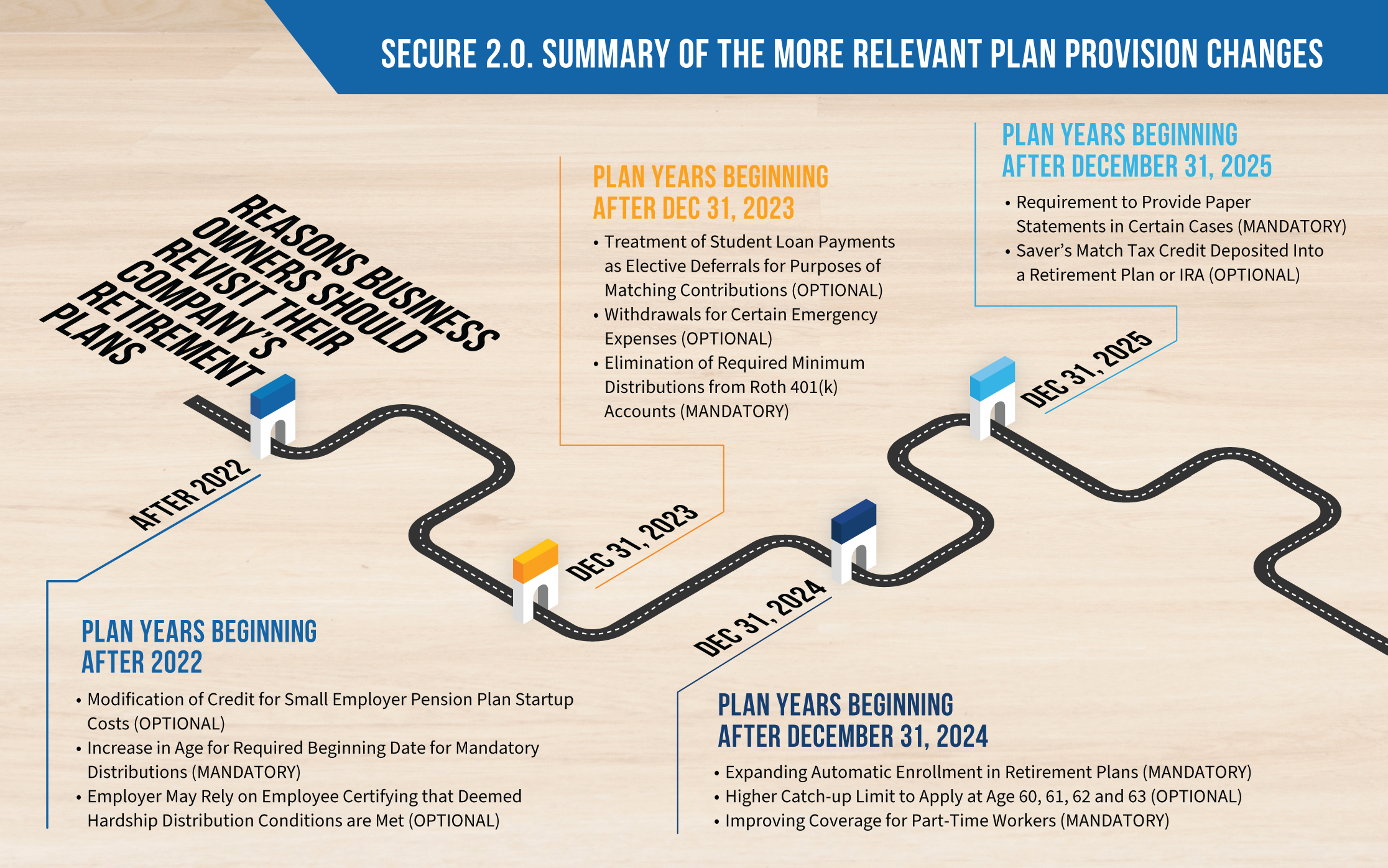

Well the original SECURE Act came out in late 2019. But if you remember what happened in early 2020 – COVID-19 hit. The government came out with the CARES Act at that time to shore up the economy so everybody forgot about the SECURE Act because it was only in place for about three or four months. Then SECURE 2.0 came out in December 2022 with over 90 new changes, including revisions to the original SECURE Act.

CI

As complex as some of the rules already are, is it true there are more significant changes - both optional and mandatory - coming to retirement plans?

Adzema

We have not seen such sweeping changes that are now occurring since the original Employee Retirement Income Security Act (ERISA) which was passed in 1974. The SECURE 2.0 Act includes, like I said, some 90 provisions, which are being phased in over a 5-year period. You’ll definitely want to review the attached infographic for some of the highlights you and your tax advisor need to know. Of course, we’ve already been communicating with our clients on these matters. I’d like to encourage any business owner out there interested in creating or replacing their plan to contact me directly at 440-202-3262 or jadzema@nationalassociates.biz.